Welcome to The Greens Estate’s comprehensive guide to navigating property taxes in Ghana! As a savvy investor, mastering these nuances is crucial for strategic decision-making and a rewarding journey in the vibrant real estate market.

Unraveling Property Tax

Property tax, also known as property rate, is a vital player in fueling local government finances. Applied to immovable structures like houses, apartments, estates, and commercial spaces, it powers essential services such as infrastructure development, education, and healthcare. Understanding this financial ecosystem is fundamental for a successful investment venture.

Your Responsibility Defined

Governed by the Local Governance Act, property taxes are overseen by District Assemblies as primary authorities for levying and collection. This ensures an equitable distribution of resources within their jurisdictions. Grasping your responsibilities as an investor fosters a smoother and more informed ownership experience.

Cracking the Calculation Code

The Lands Commission takes the lead in calculating property taxes. Through meticulous assessments, they determine the rateable value of your property – reflecting the current replacement cost after factoring in depreciation. The District Assembly then applies a predetermined rate to this value, arriving at your final tax figure.

Exemptions and Remissions

While most real estate is subject to property tax, exemptions exist for specific cases. These include premises dedicated to public worship, cemeteries, charitable institutions, public hospitals, and properties owned by diplomatic missions. Additionally, individuals over 70 and full-time students enjoy exemptions from the basic rate.

Beyond Property Tax

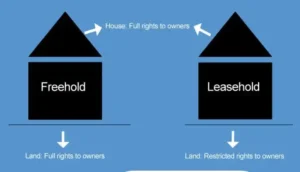

Two additional taxes contribute to the financial landscape: ground rent and real estate VAT. Ground rent, an annual fee paid to the Lands Commission, acknowledges the rightful owners of the land. Real estate VAT, a 5% tax on commercial properties introduced in 2015, adds another layer to consider.

The Greens Estate Advantage

Choosing The Greens Estate means choosing a partner committed to transparency and unwavering support. As you navigate the intricacies of property taxes, our dedicated team stands by your side, providing expert guidance and ensuring a seamless experience throughout your investment journey.

Empowering Informed Investment

Knowledge empowers. By understanding property taxes, you transform into a confident investor in Ghana’s booming real estate market. The Greens Estate offers expert guidance, a diverse portfolio of properties, and the unwavering support you need to thrive. Contact us today, and let’s embark on a journey towards your prosperous future together.